Save Money On Your 2020 Taxes!

All Things Runnion

October 8, 2020

Equipment must be purchased and placed into service by 12/31/20

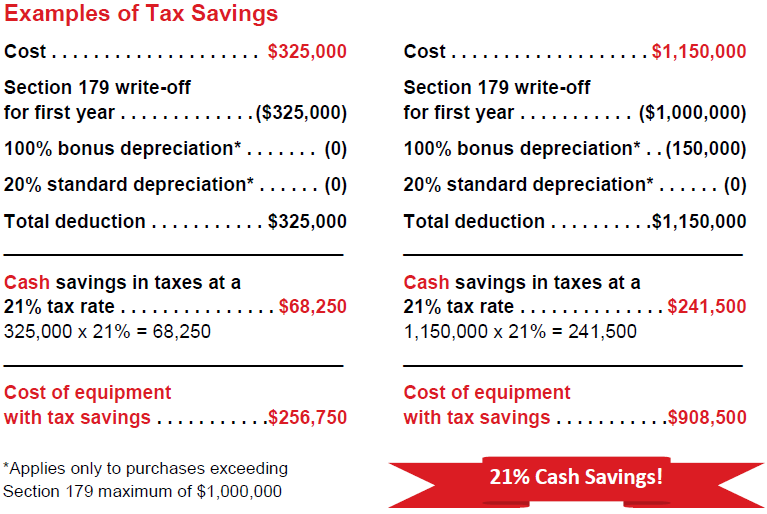

- 100% Bonus Depreciation on new and used equipment purchases

- Section 179 Expense Provision allows a deduction up to $1,040,000 with a $2,590,000 cap on expenditures for new and used equipment purchases

*This information should not be considered tax advice. Consult your tax advisor or the IRS for additional information.