Save Money on Your 2025 Taxes!

All Things Runnion

Blog Posts

November 12, 2025

What’s new under the One Big Beautiful Bill Act?

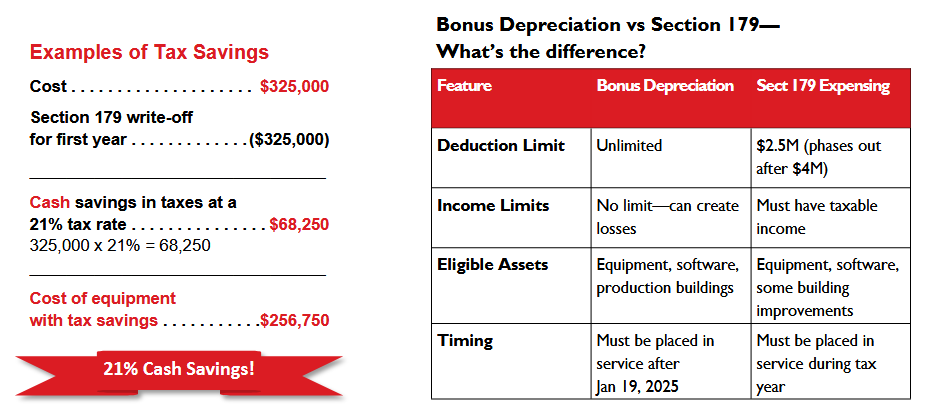

100% Bonus Depreciation is back – and it’s bigger than ever!

- Deduct 100% of the cost of qualifying equipment in the year it’s placed in service.

- No dollar limit – great for large scale investments.

- For equipment placed in service after January 19, 2025.

- Benefits for you include immediate tax savings, boost cash flow, and free up capital for reinvestment.

- Applies to new or used equipment.

Section 179 Deduction – Related but Separate

- While bonus depreciation is uncapped, OBBBA also raises the Section 179 expensing cap to $2.5 million, with a phase-out after $4 million of qualifying property placed in service.

- Section 179 covers tangible personal property and some real property, but operates independently of bonus depreciation limits.

What's New for 2025:

*Equipment must be purchased and placed into service by 12/31/25

**Note: This information should not be considered tax advice from Runnion Equipment. Contact the IRS and your tax advisor for details